Hi friends, hope we’re all keeping well.

Towards the end of March, I had the opportunity of participating in a stock pitching competition that was held by the Trinity Student Managed Fund (SMF). It was an annual, 3-round competition open to all 1st and 2nd years, with the grand prize being a summer internship with DAVY, a prominent financial services firm in Ireland.

Let’s talk about it in this post.

Introduction

Now, let me preface this by saying that I knew for a fact I wasn’t going to make it anywhere near the finals. I only joined the SMF in my 2nd year, whereas many of my competitors were already heavily involved with the fund since their 1st year. I felt (and knew) that I didn’t know anything about investment analysis, and even in my own sector (real estate) I constantly felt I was lagging behind everyone in terms of understanding concepts and trends.

However, the one thing that virtually all previous participants of the competition said, that motivated me to at least try, was how much they learned. Participating in the competition essentially supercharged their learning and understanding of finance, and that it was overall a good experience no matter where they ended up finishing in.

So, in the grand pursuit of knowledge and a fun experience, and maybe with a little nudging from my sector manager, I decided to sign up.

Round 1

The first thing you had to do was obviously pick a stock to pitch. The key advice that a semi-finalist from last year gave to me was to pick a company you actually liked. Now, I’m not going to lie, this stage was actually one of the toughest for me simply because I didn’t have any idea of a company to pitch.

On one hand, I wanted to pitch a good, stable, investable company that was almost certainly a good stock pick, like Apple or Microsoft. The problem with that is two-fold:

- These were most likely also going to be companies that everyone else was pitching and

- If I chose a company that was already in the SMF’s portfolio (which usually consisted of pretty solid companies), it’s guaranteed that I would be grilled on it until the end of time, since the judges must already know a lot about the companies

So, faced with these decisions, and remembering the advice of my senior analyst, I decided to pick a company that actually interested me and even was a bit close to heart; the home of the Golden Arches:

McDonalds.

There were a few reasons for my choice. Firstly, I felt it was a big enough company, and therefore solid enough, for its general finances to be okay. And after scanning through its key financial ratios and earnings reports, it was true.

Secondly, and quite hilariously and sadly, it was a restaurant that I went to quite frequently during the dark grind for the Scholarship exams. At the time, it was possible to get 4 burgers from the Euro saver menu for €5 (a trick taught to me by a friend, which for a broke student was an absolute bargain), and so is quite close to heart because it fed me quite well during that period.

(Putting this experience into writing really puts into perspective how bizarre a time that period was, so much so that a fast food chain has become a company I hold dear thanks to their bargain deals….)

Lastly, and probably the main reason, was because McDonalds had a genuinely interesting business model. This video explains it really well, but if I ask you right now how you think McDonalds makes its money, what would you say?

I’d imagine a good many would say food and drinks, right? But in reality, McDonalds actually makes the majority if its millions through its vast real estate empire. This concept really interested me (given I was also an analyst in the real estate sector), and so I decided to further research and investigate it.

With the company idea down, the next stage was building the pitch’s powerpoint slides.

For the first round, they were quite lenient with what slides had to be in it. The main ones that had to be included were:

- Investment Thesis. Why this sector? Why this sub sector? Why this company? These were the main questions this slide had to answer

- Business Overview. How does the company make its money? All qualitative essential information was inserted here. For McDonalds, that includes additional information about its franchising operations and such.

- Financial Overview. Pretty much just graphs of its recent ratios and finances. Has their revenue been growing or declining? What about capital expenditure? Debt to Equity ratio? Etc

- Risks. What qualitative risks does the company face? What about its beta?

For the 1st round, I also included a company snapshot, which depicted McDonalds’ stock price performance over the last year with explanations of decreases and increases, and a macroeconomic position which broke down the current economic environment for the fast food industry. I also included a slide that compared McDonalds to its competitors like Wendy’s, KFC and Burger King (although it was through this competition I found out a lot of them are owned by a single brand), and compared their key finances to draw some inferences.

Overall, this was a pretty straightforward stage and just involved finding the information and putting it (somewhat neatly) onto the pitch slides. So many excellent resources were found here too. The day before the pitch, I ran it through my sector manager who essentially told me to not read everything on the slides as time was also limited, which was very fair.

I remember the day of the pitch I was pretty nervous at the start, but got more and more into it the longer it went on. I got caught out with a few questions which was frustrating, but expected. A few days later, I was informed I had made it to the second round.

Round 2

This is where things started getting a bit more serious. 100+ people had applied to the competition for round one, which was then whittled down to 40~ for round 2. Only 5 of us would be advancing to the next and final round.

The requirements here also became more stringent. Firstly, a proper valuation of the model was required. This could’ve been either a dividend discount model or a discounted cash flow model (neither of which I had any idea actually were at the time). A more thorough analysis of the company’s competition was also required, which meant I also had to dive deeper into the finances of McDonalds’ competitors.

If I could sum up this round in one word, it would be cramming. The building of the valuation model, or rather actually learning how to build one in the first place and what everything meant, was tedious. It certainly took longer than anything else I had to make/learn for the competition, that’s for sure.

In the end, online templates, walkthroughs, and Investopedia saved my ass. CapitalIQ and Bloomberg also got locked into memory as essential finance resources. My pitch got refined a bit more, and I even added in a few cheeky extra slides in case the judges asked me about some specific stuff like ESG policy. By the end of it, I had probably 15~ total slides in the pitch, with a (seemingly) functioning model.

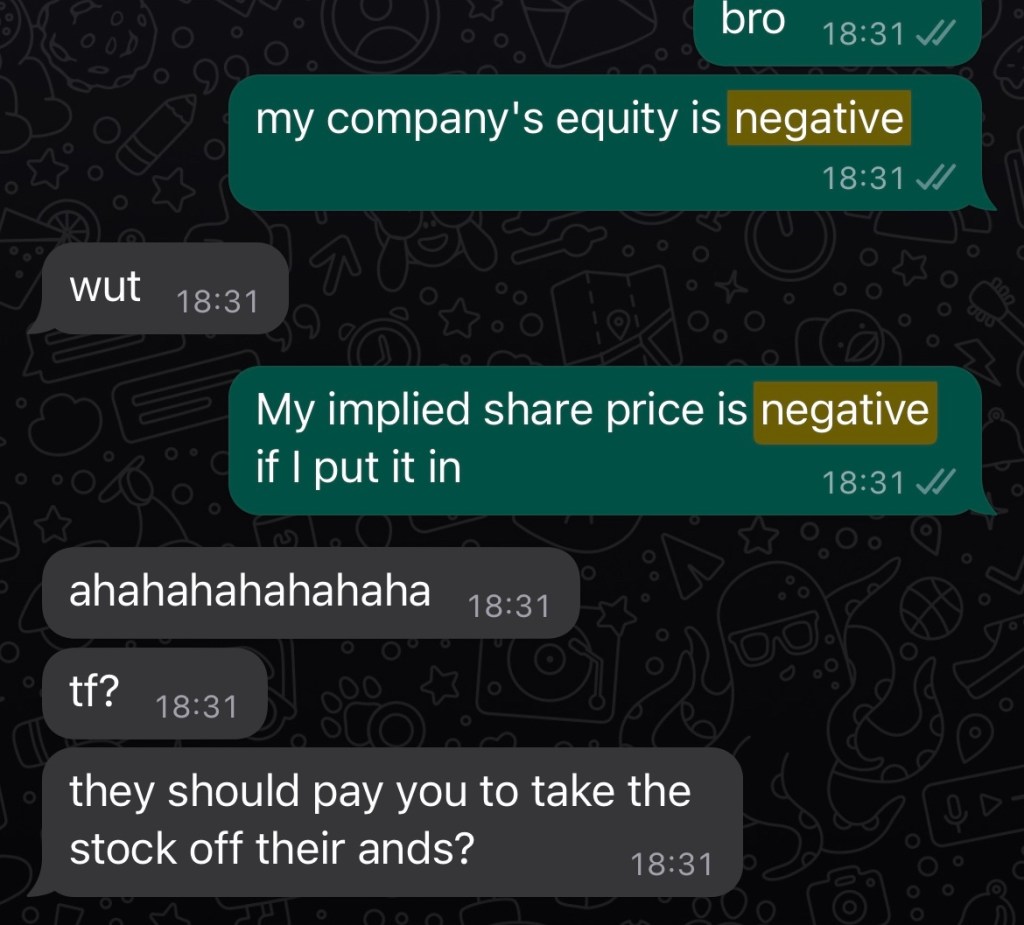

I remember, quite hilariously, after I had spent so much time building the model (which was a DCF model, for anyone with finance knowledge reading) and finally getting results, it literally valued my company as negative…meaning the implied share price was negative😭😭😭. Thankfully I fixed it up a little bit and got somewhat decent results in the end.

With all said and done, I felt my pitch for round two was actually even better than my round one pitch. Even though the judges still pointed out mistakes and flaws with my pitch, they did agree that the company had some good potential, especially for earnings as it had continuously beaten expectations. I had walked out of the room pretty satisfied, knowing I did as best I could at the time and with no regrets.

And even though I didn’t advance into the final round , I’m still so happy I participated because of how much I’ve learnt. The final round was fierce, and all 5 finalists were clearly prepped to the teeth (the eventual winner had like 50 slides in her appendix (!!!!)), and very much deserved their placements in my opinion.

In the end, I can say with full awareness of the cliché, that this was a challenge I have zero regrets taking. While the going got tough sometimes to the point I had to neglect academics for a few days, I’m walking away from this experience with treasure troves of knowledge I would’ve otherwise never acquired had I not bothered entering.

For incoming Trinity SMF students or any other prospective stock pitching competition participant, I wholly encourage you to enter and do your best! It was so worth it in my opinion, and definitely a highlight of my 2nd year in college.

Leave a comment